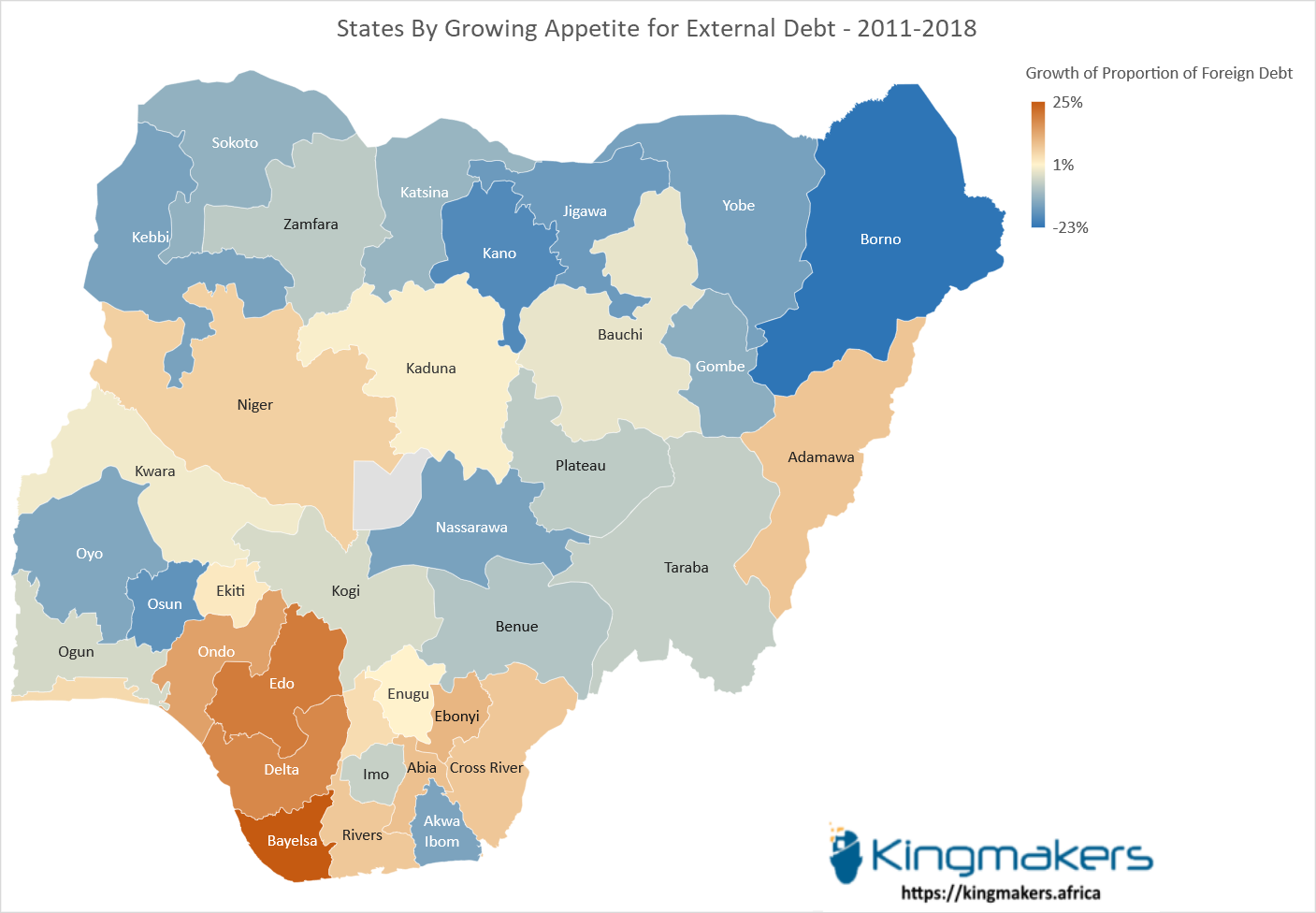

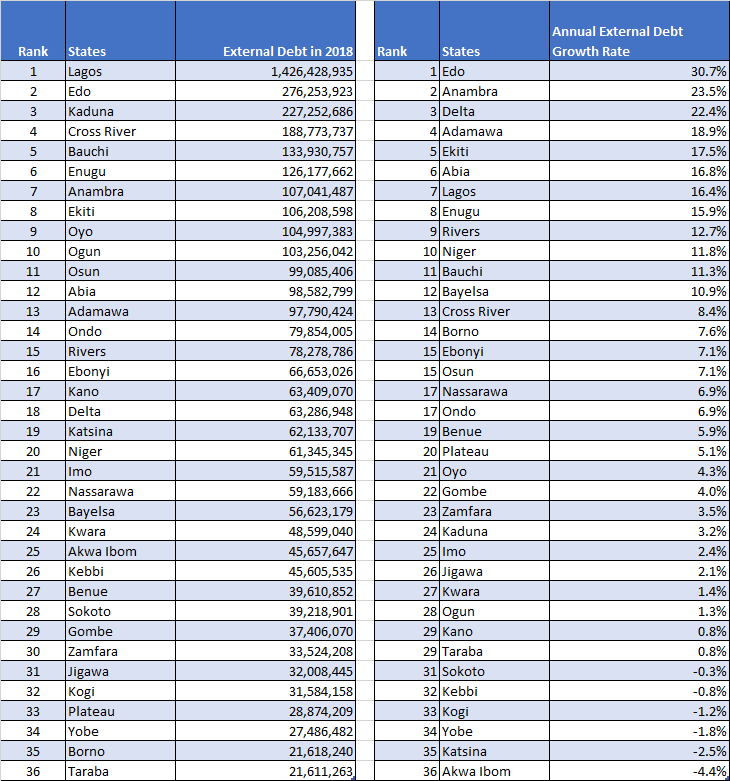

According to the Debt Management Office in Nigeria, for most of the last decade, the external debt portfolio for the state governments increased from a total of US$ 2.2 billion in 2011 to $4.23 billion in 2018. Lagos State alone was responsible for 45% of that increase, seeing its share of the total external debt increase from 22.7% to 33.7% over the 7 year period.

Other states like Edo have seen their annual growth rate of external debt hit the 30% mark, with its external debt increasing from just US$42 million in 2011 to US$ 276 million in 2018, and the proportion of the external debt to total debt for the state increasing from 14% to 49.3% over the same period.

Another state which has seen its proportion of its external debt portfolio increase to almost half of the debt it owes is Anambra. In 2018, external debts formed 49.5% of its debt profile, the highest in the country, down from a massive 91% from the previous year. This is mainly because of a ten fold increase in domestic borrowing the following year.

Bayelsa, though a bit adverse to external debt as compared to other states, has seen the fastest growing proportional change of external debt from 2.5% in 2011, where it topped the list of domestic state government debtors to 11.5% in 2018. Its ratio of external debt is 4 times still less than chart topping Edo and Anambra but clearly growing.