We carried out a study to look at the debt profile of all the states in Nigeria covering the period of 2011 to 2018, to find out which ones have been sustainably managing their debts, and what we found out is that all except one was able to do so.

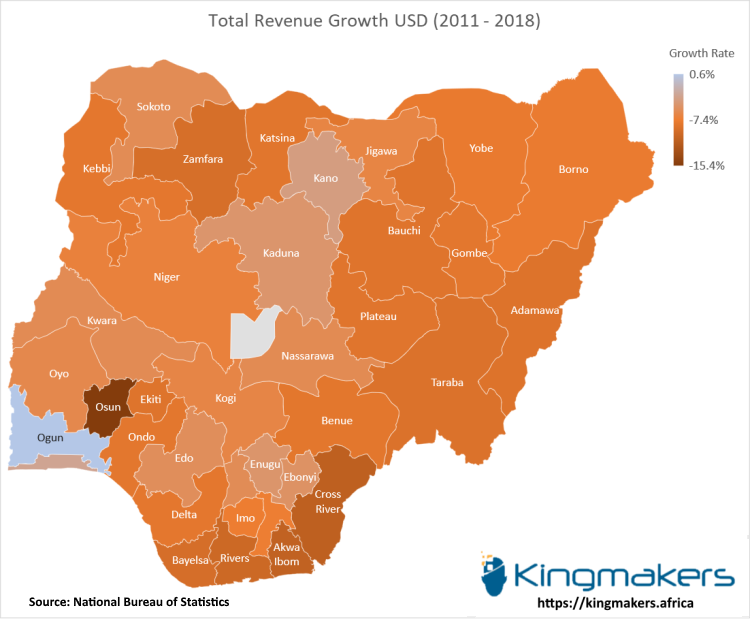

First of all we took, the revenue data for all the states spanning the same period for both the internally generated revenue (IGR) and the allocation each state receives from the Nigerian government, summed it and then converted it to the US dollar equivalent using that average conversion rate for each particular year. We then determined the annual growth for each state over the stated period.

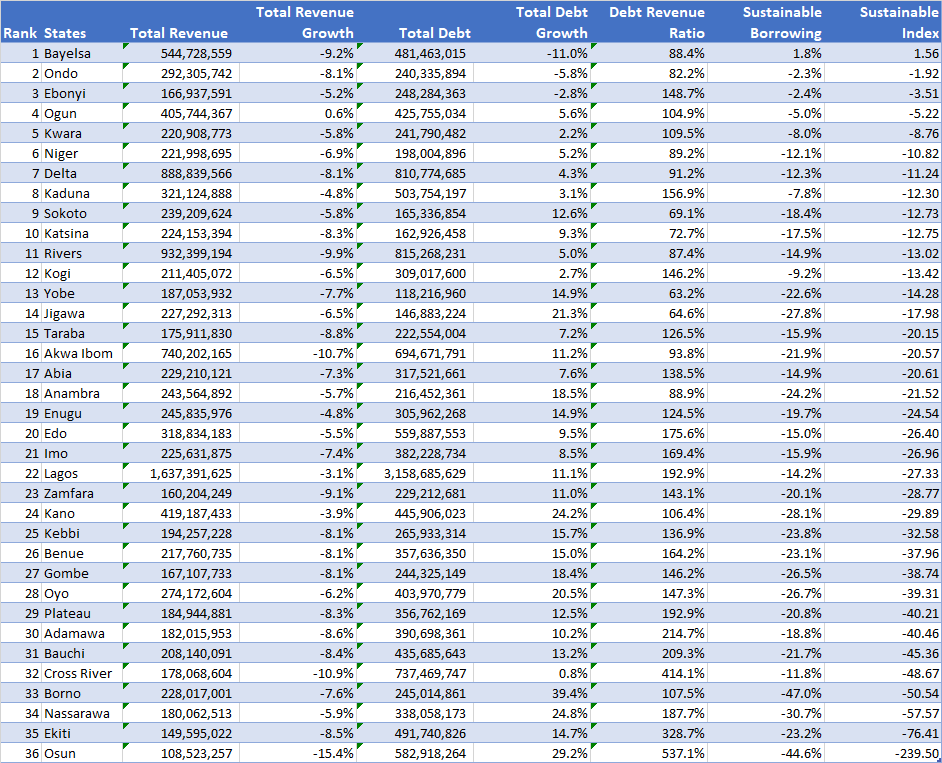

The results showed that the out of the states, that only Ogun state had an increase in its’s total revenue in US dollars over the eight year period. This was primarily driven by the growth in internally generated revenue. All states which saw an average fall of 9.4% in their federally allocated revenues, however Ogun State was able to overcome a 12% fall federal allocations by growing its IGR by annual rate of 21.6% from US$ 70 million in 2011 US$ 276 million in 2018.

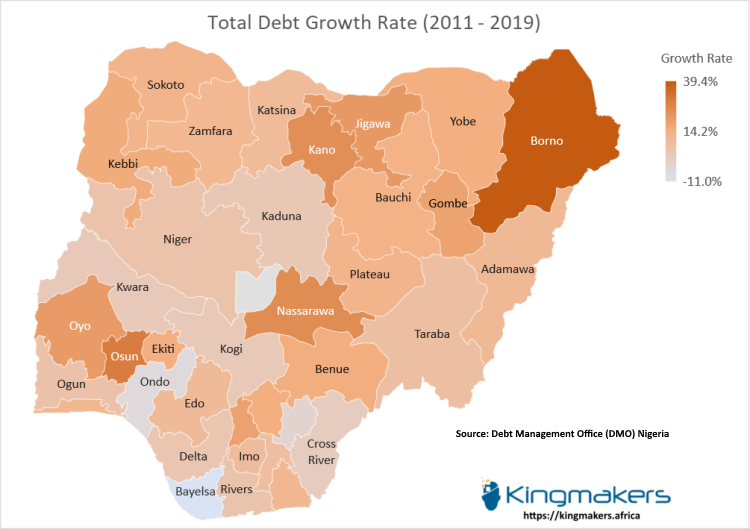

Next, we got the dollar equivalent of the domestic debt over the same period, summed it up with the external debt to determine the total debt of each state and calculate the annual growth rate. Only 3 states, Bayelsa, Ondo and Ebonyi had negative growth rates.

We then used the data we had to draw up a sustainability index to determine which states are effectively managing their debt profile in a way that is sustainable.

Here’s how we calculated the index

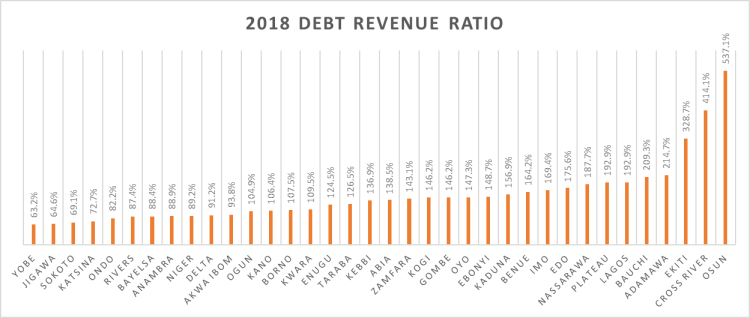

Our calculation are based off that used in the book, The Debt Trap in Nigeria: Towards a Sustainable Debt Strategy edited by Ngozi Okonjo-Iweala, Charles Chukwuma Soludo, Mansur Muhtar. First, we determined the debt revenue ratio for 2018, which is the total debt owed by the state in 2018 compared the total revenue accrued in that year. Ratios above 100% were indicative that the state had more debt than it could currently generate revenue for.

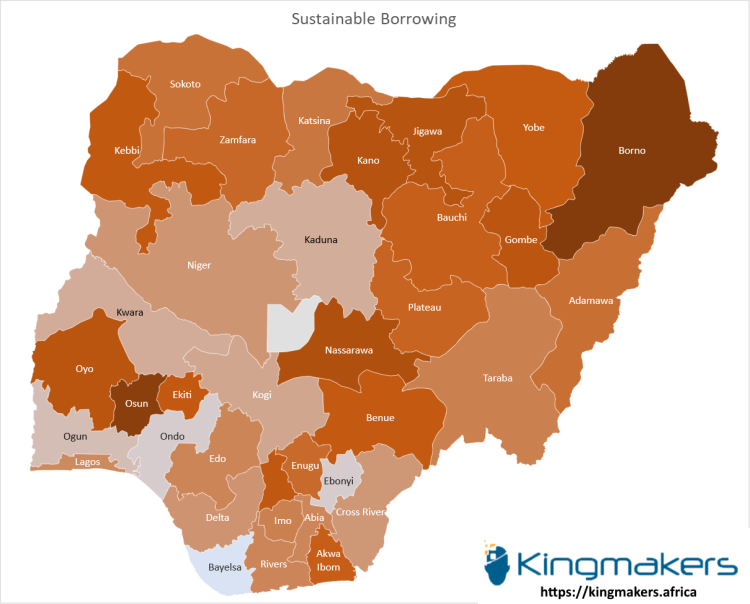

We then determined the sustainable borrowing rate, which is the difference between the growth of the total revenue and that of the total debt. Only values of more than zero were considered sustainable.

Finally, we determined the index by multiplying the revenue debt ratio with the sustainable ratio. The result was then multiplied by a 100, and that gave us our debt sustainability index. The results are show below with only Bayelsa State seem to meet that criteria of effectively managing its debt sustainably.

Assumptions Made

We do not have the data on the the interest payments made on the debts owed by the states, as that will have been factored in determining if the debt levels are sustainable but still believe that our methodology provides a rough guide in helping us examine the debts levels and the ability of the states to sustain such levels.